The "Scholarship Safety Net": Turning Unused 529 Funds into a Retirement Head Start

For many parents and grandparents, the biggest hesitation with 529 plans has always been the "what if" scenario. What if your child gets a full scholarship? What if they choose a path that doesn't require a traditional four-year degree?

Until recently, "overfunding" a 529 meant facing taxes and a 10% penalty on non-qualified withdrawals.

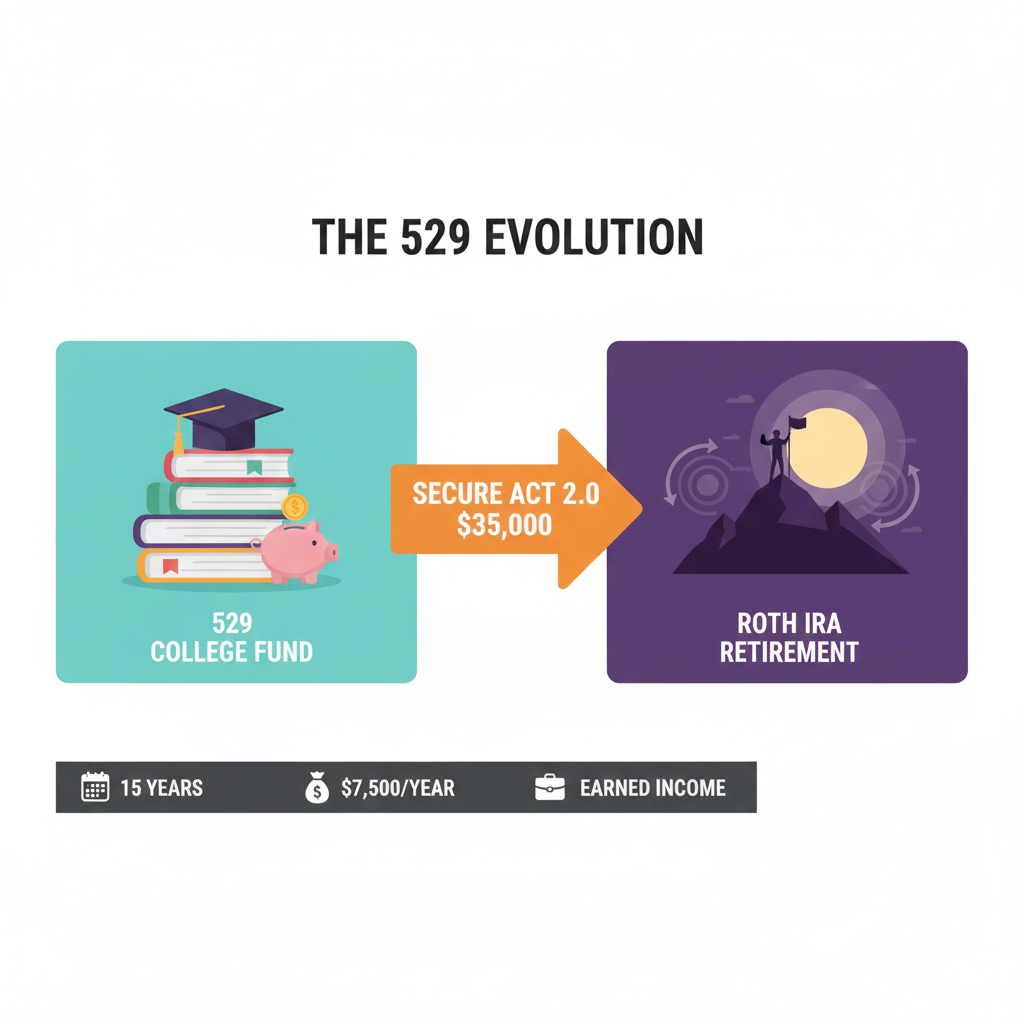

Enter the SECURE Act 2.0. As we move into 2026, the strategy for unused education funds has officially shifted from "liquidation" to "legacy." You can now roll over up to a lifetime limit of $35,000 from a 529 plan into a Roth IRA for the beneficiary—completely tax and penalty-free.

Why this matters for your 2026 planning: A $35,000 Roth IRA infusion for a young adult can be life-changing. If rolled over in their 20s and left to grow at a hypothetical 7% return, that "leftover" college money could potentially grow to over $600,000 by their retirement age, all of it accessible tax-free.

To qualify for this tax-free transfer, four specific IRS criteria must be met:

The 15-Year Rule: The 529 account must have been open for at least 15 years.

The 5-Year Rule: Any contributions (and earnings) made within the last 5 years are ineligible for rollover.

The Annual Limit: You cannot roll over the full $35k at once. The transfer is limited to the annual Roth IRA contribution limit ($7,500 for 2026), and the beneficiary must have earned income equal to the rollover amount.

Trustee-to-Trustee: The funds must move directly from the 529 provider to the Roth IRA.

Don't wait until the account is "empty" to think about this. If you have a child entering the workforce this year with leftover 529 funds, 2026 is the perfect time to initiate the first of several annual transfers to maximize their tax-free growth.

Is your 529 plan older than 15 years? Let’s look at your beneficiary's earned income and see if we can start their $35,000 "retirement kickstart" this year.

This information is for educational purposes only and is not intended as specific tax or investment advice. Lifetime limits apply per beneficiary. State tax treatment of 529-to-Roth rollovers varies by state (some states may treat the rollover as a non-qualified withdrawal). Always consult with a qualified tax professional before initiating a transfer. Past performance does not guarantee future results.